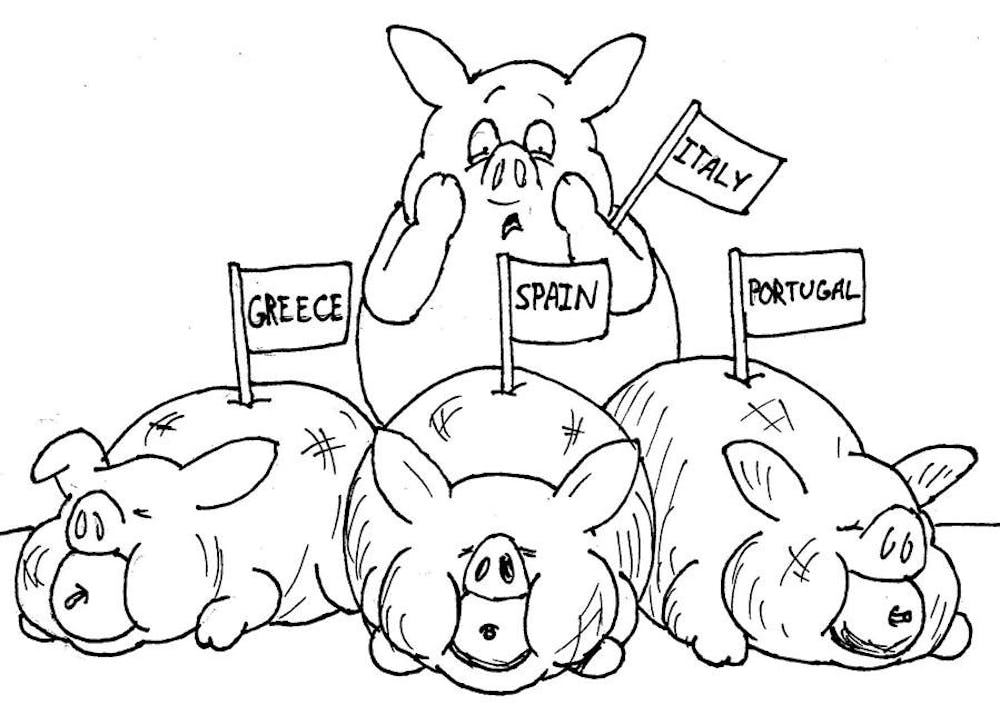

The debt crisis touched off by fears arising this past winter that Greece might not be able to pay off its massive government obligations worsened this week as Standard & Poor’s downgraded Portugal and Spain’s credit ratings as well.

Portugal, whose rating was downgraded from A+ to A-, and Spain, whose rating went from AA+ to AA, are still considered investment grade and thus remain in better shape than Greece, whose rating was recently downgraded to junk status.

However, Spain’s larger economy (which is some four times that of Greece’s) means that its downgrade could cause much greater damage than might result from a Greek default.

Investors the world over are waiting expectantly for the announcement of what will likely be a joint bailout of Greece by the European Central Bank and the International Monetary Fund ahead of the upcoming May 19 deadline when the country owes billions to major creditors.

The consensus among policymakers in Europe is that Greece cannot be allowed to default on its loans and that a bailout is imperative. A worrisome question, however, is whether it would even be possible to bail out Portugal as well (or worse, Spain) after a Greek bailout.

In light of this nearly unfathomable possibility, the wisdom of setting a precedent by bailing Greece out is called into question.

Proponents of a bailout counter that, despite the steep cost of such a bailout (estimates range from $60 to $150 billion), it will be necessary to maintain the economic stability of the European Union as a whole and, potentially, the survival of the euro itself.

This rationale is a somewhat dubious one, however.

As Daniel Gros, the director of the Center for European Policy Studies, noted yesterday, the Greek economy accounts for just two percent of the euro area’s gross domestic product.

Additionally, the country “is not home to any systemically relevant financial institution,” he wrote.

Gros went on to argue that allowing a Greek default would likely demonstrate the economic strength of the euro area by showing that the bloc could survive the economic collapse of one of its members.

Taking such a course of action would also set a healthier precedent for Portugal, Spain and other countries with high debt loads, which would get the message that spendthrift countries that are unable to get their finances in order cannot expect to be bailed out by countries that have kept their balance sheets in good standing.

Hey, Europe! Let Greece fail

Get stories like this in your inbox

Subscribe