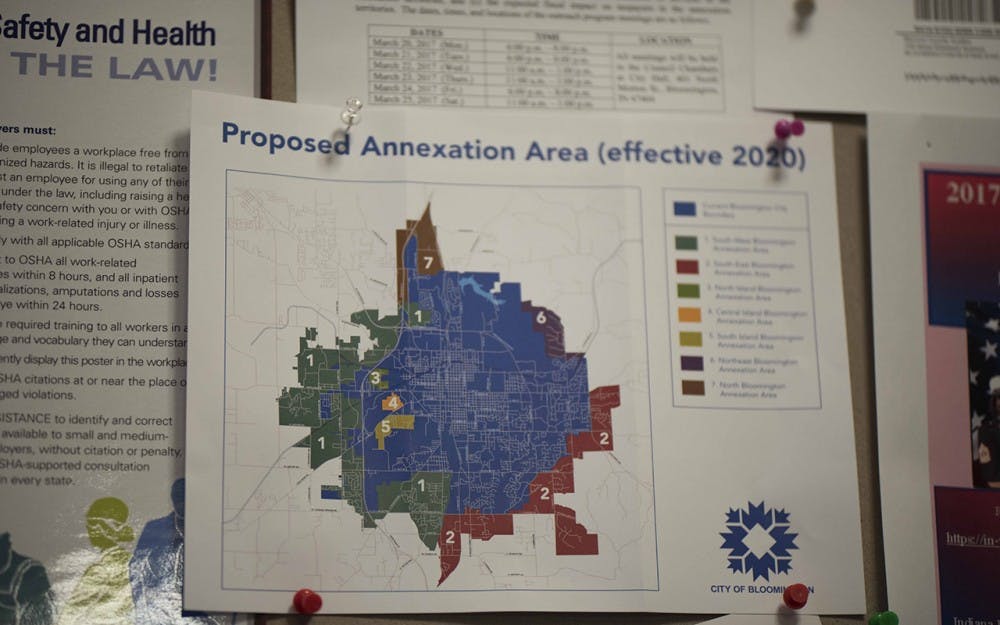

In their first session since Bloomington city council approved resolutions to discuss the annexation of seven areas in and around the city, the Monroe County Council discussed its potential budget effects at Tuesday’s meeting.

County council member Geoff McKim presented a self-done fiscal analysis of how the annexation of approximately 10,000 acres and 15,000 people into official limits of the city of Bloomington will affect the county. Effects estimated by the report include an overall loss to the county of approximately $800,000 in the first year of annexation.

If annexation passes, the city of Bloomington would gain $291,000 from public safety local income taxes, according to McKim’s report. The city’s report estimates $288,000. Monroe County would lose $271,000 a year after annexation in public safety local income tax.

By McKim’s estimates, Monroe County would lose more than $1 million in local income tax revenue.

If annexation is approved by the city — which is expected to happen this year — annexation would not take effect until Jan. 1, 2020. Many townships in annexation areas are in fire district agreements until that year.

The city of Bloomington would gain more than $100 million in local income tax revenue, according to McKim’s estimate.

The Monroe County Commissioners have hired an outside analysis firm to do another county fiscal effects report, with results to come in the following weeks.

A fiscal projection report released by the city when the annexation proposal was announced has little analysis of how annexation will affect Monroe County budgets.

“There is no bottom-line estimate,” McKim said during the meeting, expressing the need to have various financial estimates. “I think it’s good if we all do these calculations ourselves so we’re all informed when we see the report.”

The main difference between the city’s and McKim’s reports is which tax rates were used to make calculations. The city’s report uses 2016 tax rates, while McKim used the newly available 2017 tax rates.

The calculations omit taxes people will not pay when they are annexed, such as fire taxes for township fire departments.

“This is all as if the annexation would take place today rather than 2020,” McKim said, adding that this is an estimate should each of the seven proposed areas be successfully annexed.

One tax revenue source not mentioned in the city’s report is the cable franchise fees. Though according to McKim’s report the revenue from these fees has decreased, it is still a substantial part of their budget.

From these funds, the council has appropriated $700,000, mostly to fund Community Access Television Services. Though it is not certain how these fees will be affected by annexation, council members suggested the city make up the difference in what would be lost by the county.

Annexation has been added to upcoming county council agendas to allow time for each meeting to give reports and discuss the project.