A study released last week by Payscale seeks to answer that question by showing the average degrees’ return on investment for thousands of universities across the ?country.

Payscale is an online service that has collected a database of more than 40 million individual salary profiles and uses that data to help businesses and individuals determine fair salaries for employees, according to the company’s website.

Return on investment, calculated as a single dollar value, is a measure of the additional income degree holders received compared to if they had gone straight to work with a high school diploma.

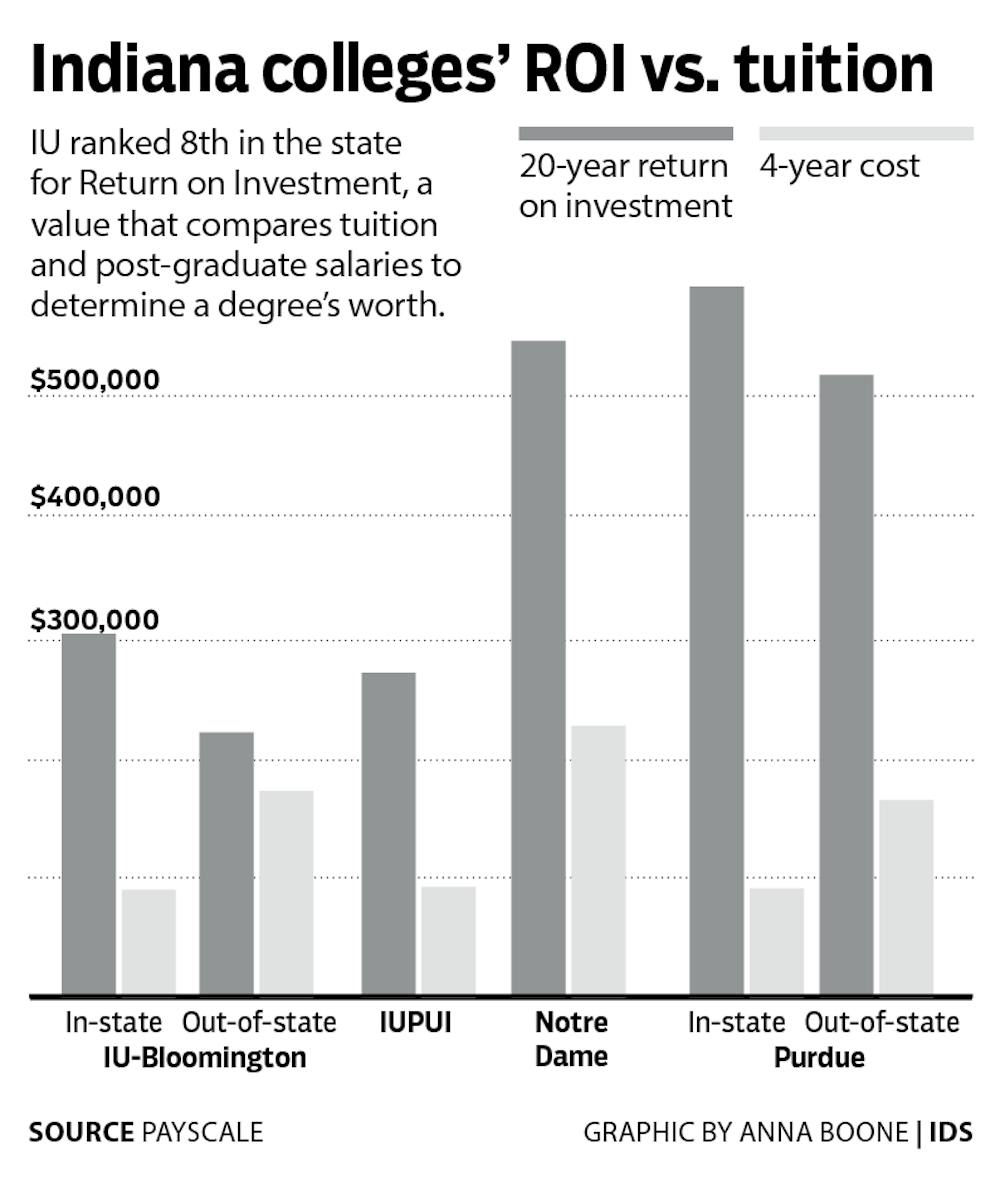

The 20-year return on investment for an in-state IU degree was $303,000, while an out-of-state degree was $220,800, ranking 397 and 655 nationally, respectively.

IU ranked eighth in the state in the report behind Purdue, Notre Dame and Rose-Hulman. A total of 30 colleges were studied.

Engineering degrees often have the highest value for undergraduate degrees, according to the report.

“In engineering there’s a path, but how do you quantify the data for a liberal arts education?” IU Financial Aid Director Jim Kennedy said.

Kennedy is in a group of administrators within the IU system that works to make the University more accessible to all students and to educate students on financial matters.

The average cost of an IU degree for in-state students is $90,000 while the average cost for out-of-state students is $172,000. The average student graduated with $30,520 in debt, according to the ?report.

The study determined the return on investment for each school by taking the median salary of a degree holder and subtracting from that amount the median high school graduate salary as well as the cost of attending the university.

The study focused solely on undergraduates and did not include data from individuals who went on to receive professional or graduate certifications.

Return on investment is strongly affected by student loan debts and payments, an area IU is actively trying to educate students in, particularly with the introduction of a yearly “loan debt” letter containing students’ total loans and estimated future payments.

“People didn’t know how much debt they had,” Kennedy said. “These loans have ramifications.”

Another IU initiative is the MoneySmarts program, which is a financial skills program for incoming students that offers financial resources to all students through the Financial Literacy office.

Return on investment is a less effective measure of a degree’s worth if students purposely choose a low-earning field they enjoy such as social work, said Phil Schuman, IU Director of Financial ?Literacy.

In cases such as these, return on investment could help a student determine how much debt to take on.

“Nothing’s worse than someone being passionate and not being able to take a job because of debt,” Schuman said.

Other IU programs include weekly podcasts and a series of one-credit-hour online classes offered on personal finances.

Additional resources for students wanting to learn more about student loans or finance in general can be found online at moneysmarts.iu.edu.

“We know financial education isn’t an awesome topic to talk about,” Schuman said. “We want to make this as approachable as possible.”