Just over a week ago, the Senate Banking Committee approved a bill that seeks to prevent foreclosures among at-risk homeowners and provide greater government oversight of the mortgage and real-estate industries. Sounds dull, right? \nBut recently it emerged that one of the bill’s new provisions is a federal database collecting the fingerprints of anyone involved with the process of providing home loans – including lenders, mortgage brokers and any real estate agents who are compensated in the course of the transaction. The definition of who exactly will have to provide their fingerprints is very broad, and could involve thousands of people in the housing industry.\nAnd it’s about time! Forget murderers, terrorists, drug dealers and practitioners of mail fraud – it is the mortgage industry that is the greatest national-security threat facing these United States today! Even now they could be scheming about adjustable-rate mortgages and two-bedroom townhouses with one-and-a-half baths and parking adjacent.\nOh sure, those namby-pamby privacy and civil liberties advocates might cry “Big Brother” over this – but they’ve never lost a loved one to a drive-by interest rate! They’ve never seen families torn apart by a loan application!\nWe’ve all heard the story before. A young kid from a broken home, with no education and no prospects, sees the opportunity to make a little extra money – so he starts providing six percent, 30-year ARMs to his friends. But the money’s too good, and he starts making riskier and riskier loans and he expands his territory, all to keep himself in Hugo Boss ties and Lexuses and those swinging-ball desk toys. As Scarface taught us, with the money comes the power – and with the power, the women. Soon he’s awash in pretty, young things drawn in by the danger and the romance of the loan-provider lifestyle. And then there’s the respect – going from nothing to the most feared source of sub-prime mortgages in the entire county – that is, until the housing bubble bursts, and debtors start defaulting – and soon he has to write off $379 billion in loans and the financial carnage gets so bad that Federal Reserve has to lower their discount rate and collateralize government securities to provide short-term loans in order to prevent a credit crunch. And in the end, looking down the barrel of a government bailout plan, the young kid realizes that the glamour, the hoochies, the tabletop air purifier from Sharper Image – none of it was worth it. But by then it’s too late.\nFor too long, the authorities have sat idly by, letting chaos and anarchy reign. But now, a bright new day of government monitoring of (not-actually) criminals has dawned! We can only hope that this fingerprint database will grow to encompass providers of car loans, boat loans, business loans, personal loans – and recipients, too. And how about anyone who owns stocks or bonds, or starts a savings account or changes a $5 bill for five $1s? Because only by controlling every last, little aspect of our lives can the government ensure our freedom.

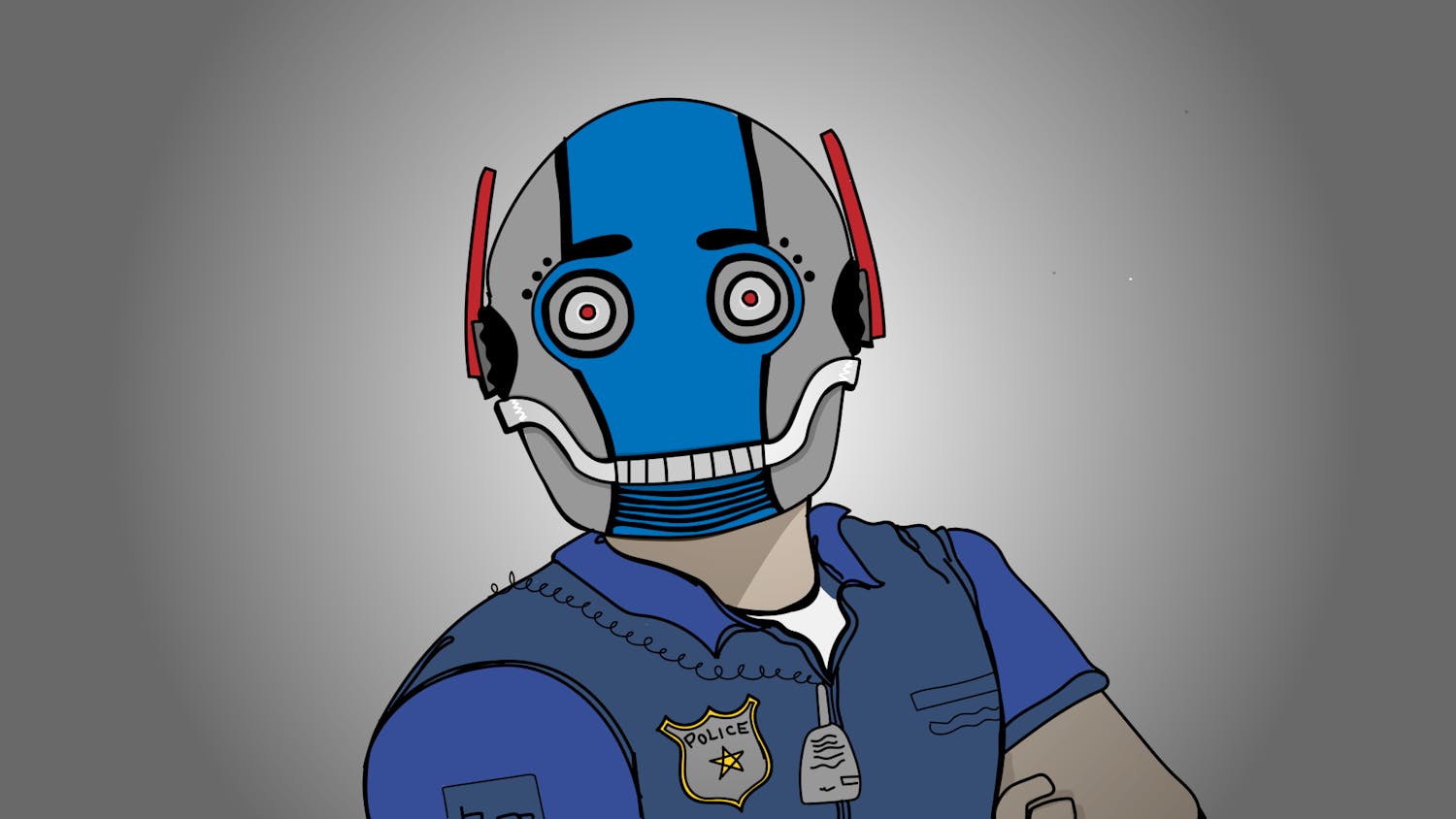

Getting the finger

Get stories like this in your inbox

Subscribe