Oftentimes it may seem uncomfortable or taboo to talk about money or your personal finances with anyone. But when you consider that your income dictates almost everything that you are able to do and even people's perception of you, it's understandable not wanting to openly talk about your finances.

Growing up, my parents never really discussed our families finances, at least not with their children. Every so often, I would catch a glimpse or a hint of how we were doing financially. And obviously — in periods around the 2008 financial crisis — I could pick up that things were a little tight, but I'm sure I'm not the only one who's experienced this.

It's important we destigmatize and begin to have more open conversations about finances, at least on a societal level. Your income dictates a lot about your livelihood, and when we look at the last half-century in our country, we see that the average American's share of wealth has sharply declined, and this is a huge problem.

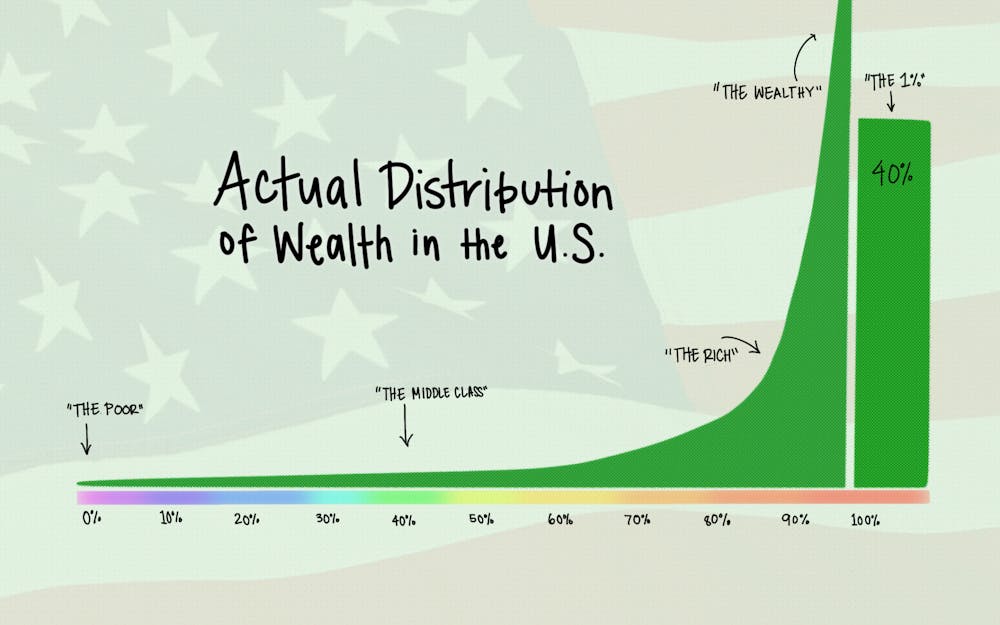

Ingrained in the creation of this country is an idea that if you worked hard and followed the rules, you could build your wealth up so that your children would have a better future. But when I look at graphs modeling the income changes in the U.S., like the one above, I see the image of a dying American dream. Obviously very few individuals were able to achieve this dream, but it’s to the extent that they've drastically diminished this same opportunity for most of the middle class.

Over the course of the last half-century, some of our nation's leaders have altered the tax code in our country to alleviate the levies against large corporations in the "hopes" that this would "trickle down" through these organizations into the pockets of everyday Americans. Sadly, this was not the case.

What this actually did was bolster the wallets and portfolios of the top 1%. And because of certain Supreme Court decisions such as Citizens United v. FEC, this bought them influence, not only in Congress but also indirectly over the larger population.

This influence has also allowed the top 1% to skew the narrative of wealth to the point where a large majority of the population has a fundamental misunderstanding of what the distribution of wealth should look like. Now, when many people hear about the current presidential administration wanting to raise taxes on the wealthiest of Americans, they worry because they believe this would affect them.

I can assure you, you're not Jeff Bezos or Elon Musk or Warren Buffett. You may have a nice cozy job at Deloitte out of college doing business analytics, but you are indeed far, far from the wealthiest of Americans.

Now I'm not saying you shouldn't take a little pride in the money you earn, but I'm tired of hearing conversations about how "burger flippers" shouldn't make a minimum living wage. We are the wealthiest nation in the world: the U.S. GDP in 2021 was greater than that of the United Kingdom, Germany, France, Italy, Canada, Russia, and Japan combined.

We are in dire need of a return to increased corporate tax rates, we need to remove money from politics and we need to open up the conversation about wealth and how to build it when you may not have it.

Sean Gilley (he/him) is a senior studying political science and economics with a certificate in informatics.