The food and beverage tax passed by the Monroe County City Council on Dec. 13, 2017 will not apply to food courts or stores on the IU campus for current students.

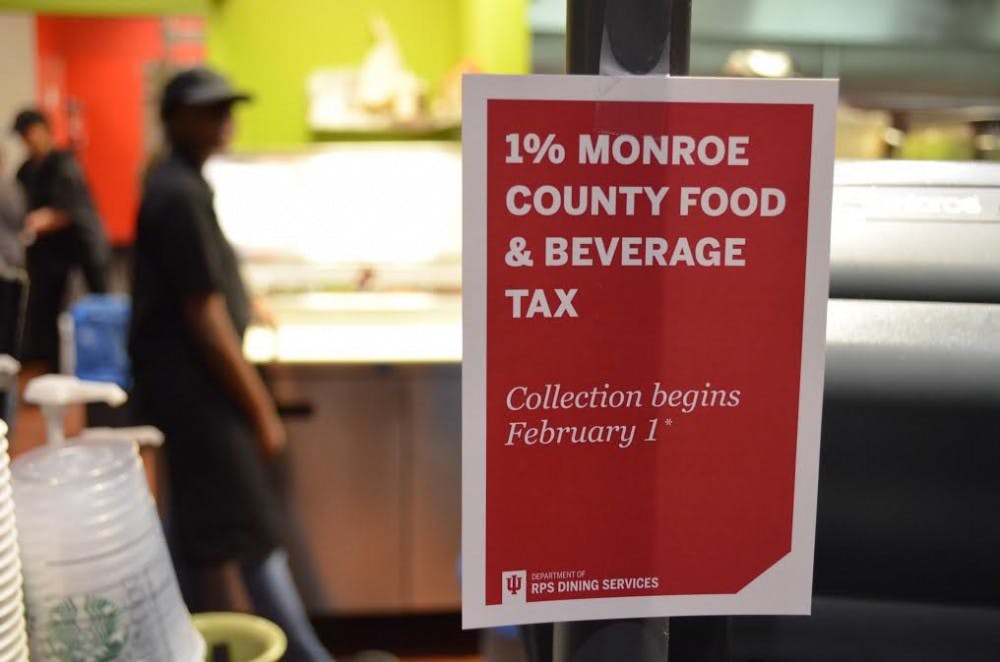

This 1-percent tax will apply to Monroe County, and it will help fund the expansion of the Monroe County Convention Center, and it applies to any transaction of food and drinks that are “furnished, prepared or served” at the store’s location.

“This will not affect students eating on on-campus locations in any way,” said Rahul Shrivistav, the Director of Dining. “We will always be tax-exempt.”

The tax includes food and beverages that are sold in a heated state or served with eating utensils, straws, glasses, or plates. Any unprepared food or previously untaxed food will be unaffected by the tax. The tax went into effect on February 1, 2018.

“It will be pretty much anything at a restaurant,” said Geoff McKim, an at-large representative of the Monroe County Council. “But ordinary groceries are not taxable.”

Although locations such as the Wright Food Court are safe, Shrivistav said that faculty, staff and visitors are expected to pay the food and beverage tax at on-campus locations. He said that only students receive a tax-exempt status on campus.

Students at the Dec. 13 meeting were divided about the tax bill, with some expressing concern that it would still disproportionately affect students. Those lobbying against the bill included the IU College Republicans club, who stated that the students paying the tax would not be able to enjoy the benefits of the convention center before their graduation.

According to a previous IDS report, some students also expressed their disapproval at the vote taking place during finals week, which made it difficult for students to express their opinions on the issue.

Lee Jones, another Monroe County Council member, voted against the bill and said that a food and beverage tax was not a good way to fund the Monroe County convention center. She said, however, that it was the only funding source that the state would allow.

“Students do seem to spend more on these foods and beverages,” she said.

McKim voted in favor of the bill and said that the convention center will benefit students. The overall vote was 4-3.

“Student groups use the convention center, students work at the convention center, they intern at the convention center,” he said. “IU uses the convention as an expansion when buildings are under construction.”

McKim said that he had been working on the expansion of the convention center for four years and that the timing of the project seemed to be appropriate. He said that it would promote tourism in Bloomington and that it would benefit the city in numerous ways.

“It’s a part of the community,” McKim said, referring to the convention center.