President Trump has the potential to alter the typical college student’s diet, a feat that no dietician has been able to accomplish so far. Among other changes, his current plan threatens the student dependency on guacamole from Chipotle, a crucial factor in student budgets.

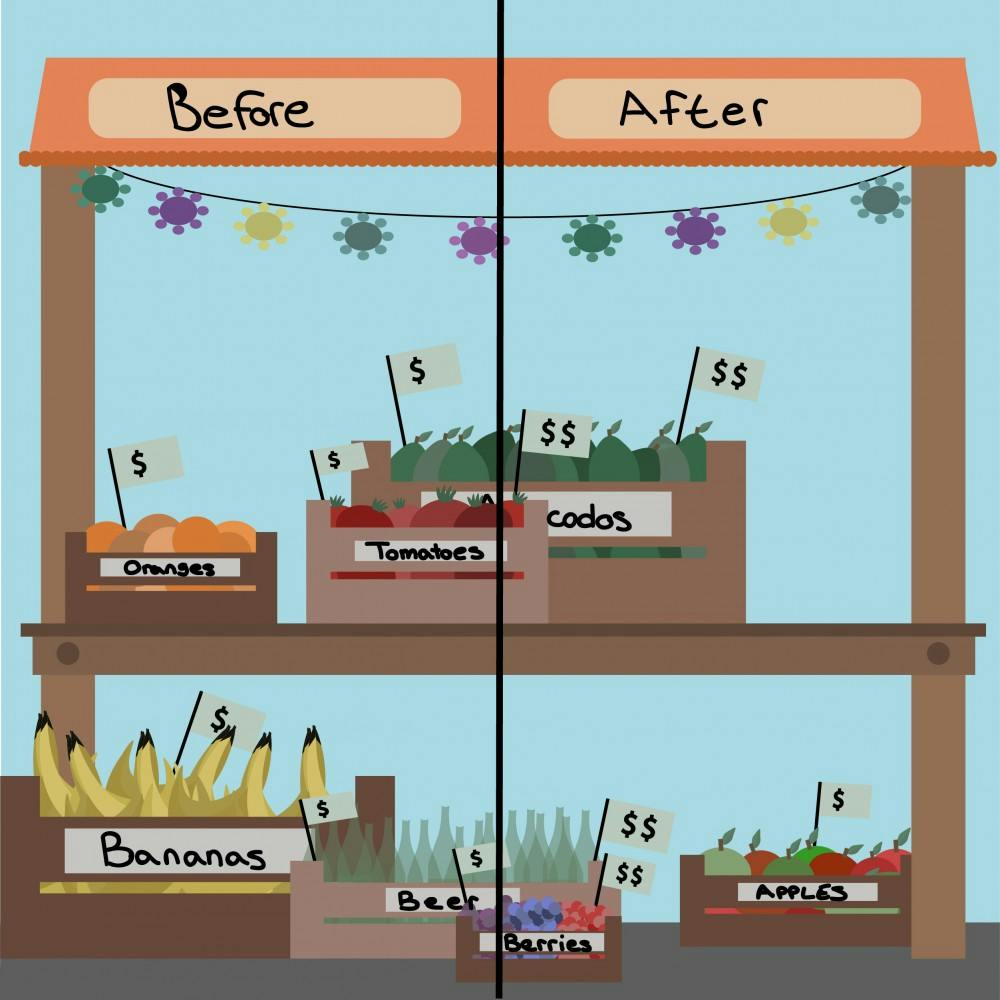

Trump recently announced his support of a 20-percent import tax on goods from Mexico. The plan is bound to slap American consumers in their food-stuffed faces. The tariff would result in increased prices of goods imported from Mexico and penalize companies with production based on that side of the border.

Mexico is the world’s largest producer of avocados, which makes the tax a particular threat to the United States’ recent infatuation with the avocado and its alter ego, guacamole. In addition to curbing consumption of guacamole-filled tacos, a reduction in avocado imports could ruin numerous weight-loss plans based around this distinctly nutritious fruit.

Mexico is also the main source of imported tomatoes in the U.S. Tomatoes alone represent nine percent of Mexican agricultural exports to the U.S. A rise in tomato prices could rule out pizza as a cost-effective option for Friday-night dinner with friends.

Furthermore, the tariff could affect college drinking habits. Mexico remains the leading exporter of beer to the U.S. and ranks third in liquor exports. If you’ve ever wondered why alcoholic drinks have Spanish-language names, like Corona and Dos Equis, it’s because they come from south of the border.

The U.S.’s long obsession with imported food took the form of military interventions, often nicknamed the Banana Wars, in Latin America in the 20th century. These military interventions were designed to protect the interests of fruit companies by supporting state interests that aligned with companies’ economic agendas for cheap labor and control over agricultural land.

Trump’s proposed tax is a shift from interests in foreign food production to a fear that jobs are emigrating across the border. The reasoning behind the tax is the conviction that it will bring back jobs from Mexico by deterring companies from producing on the other side of the border.

Indeed, we do import manufactured products from Mexico, and vehicles are the leading import from our southern neighbor.

However, it would be wrong to assume that employment has simply driven across the border.

U.S. unemployment, in fact, remained at or below five percent during 2016, with an average of 4.85 percent unemployment. In perspective, the Federal Reserve estimates that the natural rate of unemployment remains between 4.5 and 6 percent — a figure that indicates unemployment resulting from natural transitions in the economy.

Closures of U.S. factories appear catastrophic because they cause a sudden high unemployment rate in a concentrated region and make it difficult to find comparable jobs within the contiguous area.

However, factory shutdowns correspond with long-run trends in the economy rather than a mass exportation of jobs across the border.

Trump’s proposal reminds us not only to trust our gut feelings and our self-interested, college-student stomachs but to consider the economic factors that could affect consumption and production on national and international levels.