Students pay for college in a variety of ways, and many of them depend on federal funding to alleviate the burden of cost.

A recent survey administered by advocacy groups Demos and Young Invincibles for 872 people aged 18 to 34 found that three of four respondents thought college had become harder to afford in the last five years and that college loan debt had become unmanageable.

Eighty percent of the respondents agreed college education is more important now than during their parents’ generation.

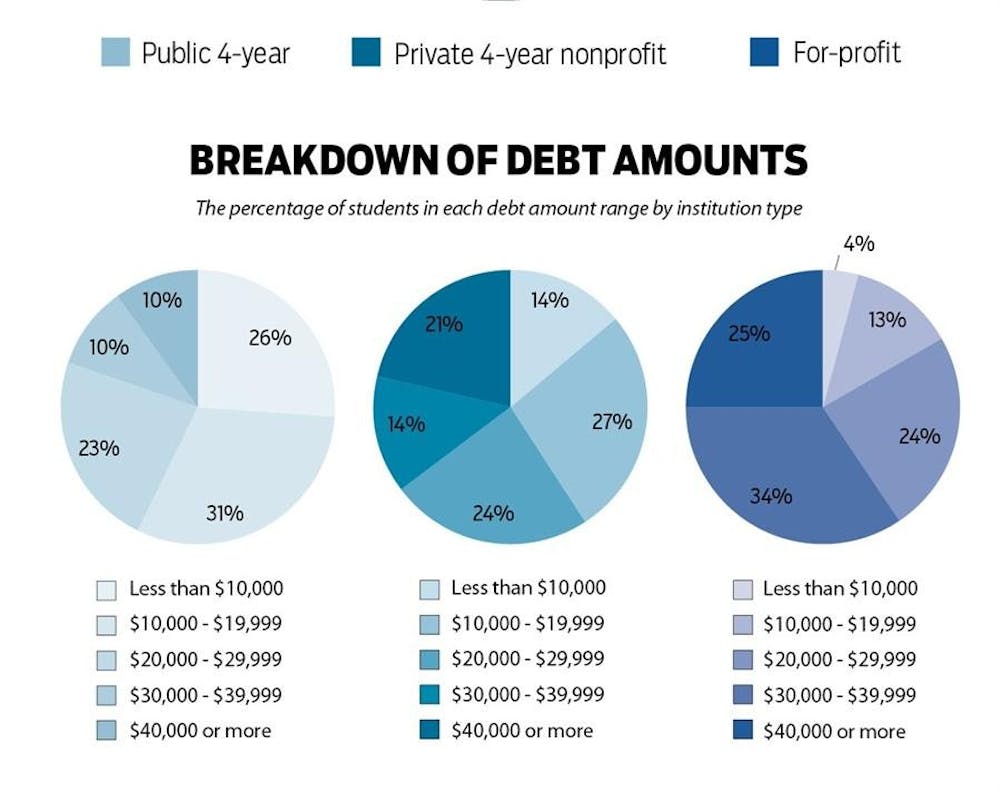

The survey also found almost 30 percent of students had more than $10,000 in student-loan debt.

Carlene Quinn, who advises students at the IU School of Social Work, said students frequently express concerns about paying for college and repaying loans after graduation.

“Some of our students are experiencing an episode of poverty for the first time in their life,” she said.

She said the School of Social Work, located on Atwater Avenue, has food pantries that get “used with some consistency.”

“I don’t assume who’s hungry anymore,” she said.

Quinn said many students are considering programs, such as AmeriCorps and Peace Corps, to pay back loans after they graduate.

Justen Warne, a senior in English secondary education, works 40 hours a week as a supervisor at Residential Programs and Services, even though he receives

federal loans.

“I just find that there’s not much aid to a working-class student,” said Warne, who transferred from IU-Northwest in summer 2010. “The loan forces you to play a zero-sum game against time and odds, and the economic forces are out of our reach.”

New legislation, such as President Obama’s Pay As You Earn proposal, will allow students with both Federal Direct Loans and Federal Family Education Loans to consolidate payments to lower interest. While interest for the Stafford Subsidized Loans is set to double July 1, 2012, the Income-Based Repayment Plan lets post-graduates who either support themselves or live with any number of people and make no more than $20,000 annually to pay nothing per month.

Students who want to pay for the school term as they go can elect to use a Personal Deferment Option that the Office of the Bursar offers. Students’ bursar balance is separated into a “Minimum Due” and a “Total Due.”

Students who use the option pay the minimum by the due date and defer the rest of the balance until the next month. The process is repeated through the course of the semester, said Kimberley Kercheval, associate executive at the Office of

the Bursar.

“Students who work part-time or who have people helping them pay the bursar bills and need to use income as it is earned find this plan very helpful, specifically because they do not have to pay everything at once,” she said.

IU also offers a variety of departmental scholarships, and incoming freshmen, based on academic standing, can qualify for Automatic Academic Scholarships.

Ron McFall, associate director for the Office of Scholarships, said the program is received by 30 to 35 percent of enrolled freshmen.

But students who don’t receive scholarship aid, stay in college beyond four years and are less likely to receive federal funding have added stress, Quinn said.

“If a student has to work a lot or at times is completely stressed out about their finances, it is going to shortchange their education,” she said.

Abby Rose, who graduated in May 2011 and studied exercise science and physical therapy at IU, said she had to take only one loan during her senior year since her parents saved up money, but she still had a job throughout college.

“Just because my parents had my undergrad pretty much paid for, it made me want to have my own money even more so because I didn’t want them to have to pay for everything else, too,” said Rose, who added that having a job never interfered with grades or a social life.

The wide range of socio-economic statuses at IU might account for severe cases of poverty and homelessness, like Quinn has witnessed with students she advises.

“It’s as if we act that the problem doesn’t exist,” she said. “We kind of turn a blind eye, and so I don’t think that sets up a student for success.”

Warne said it’s frustrating to see students at his job who don’t think twice about spending hundreds of dollars on meal points.

“As far as then and now, I think it’s a whole different paradigm,” he said of how the value of higher education has changed. “College wasn’t an option. It was

simply the next step.”

Report states students find college harder to afford

Get stories like this in your inbox

Subscribe