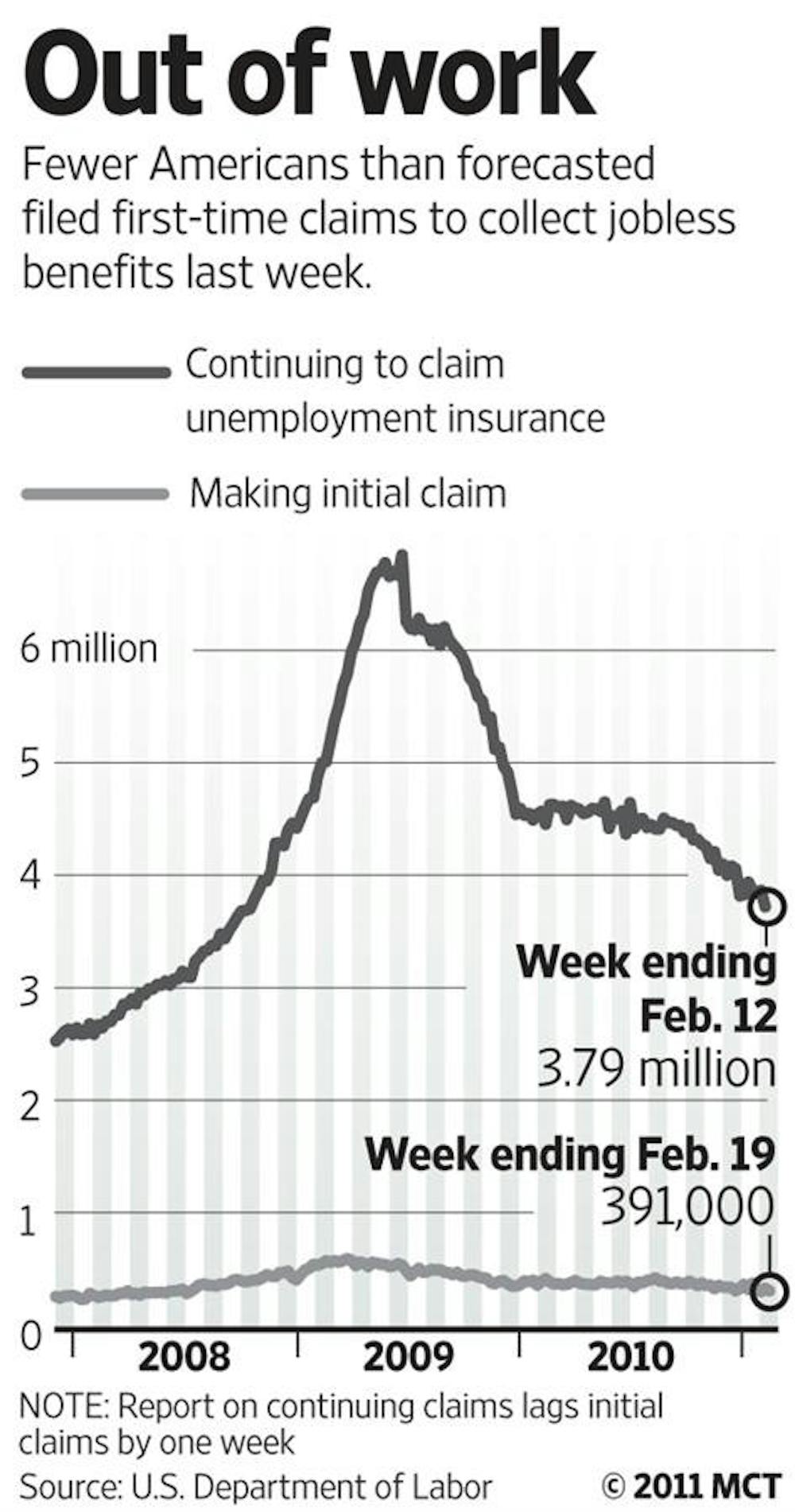

Last week, Gov. Mitch Daniels signed House Bill 1450 in the hopes that it would bring the Indiana unemployment trust fund into structural balance in two years and repay the $2 billion owed on the federal government trust fund advances by 2019, according to the governor’s press release.

The unemployment insurance system is a joint federal-state program that has been in place since the 1930s. Money in the trust fund comes strictly from premiums paid by employers — workers pay nothing for it, and it uses no general tax fund revenue. The money is held in trust by the federal government and each state has its own account. In essence, Indiana employers pay premiums for unemployed Indiana workers.

Structural balance, which hasn’t been obtained in the state in more than a decade, means the premiums coming in through payments by employers will equal the benefits going out to unemployed workers.

“Currently we are bringing in less in premiums than we are paying out to workers, and that’s where the 2 billion-dollar debt to the federal government comes from,” said Sen. Brandt Hershman, R-Lafayette, Senate co-sponsor of HB 1450.

The new law, which is to take effect immediately, will restructure the formula for unemployment benefits — which could reduce the amount of benefits distributed to seasonal workers and raise taxes on businesses.

“Not only is this bill going to reduce benefits by 25 percent for unemployed families, it’s going to take money out of local economies all across the state,” Senate Minority Leader Vi Simpson, D-Bloomington, said in an e-mail. “Unemployment benefits are spent on necessities at local businesses — the hometown grocery stores, pharmacies and gas stations.”

Hershman said although the bill may reduce unemployment benefits for seasonal workers, the restructured formula will not significantly affect full-time employees.

Previously in Indiana, unemployment benefits were determined by calculating a worker’s highest quarter of earnings in a year and paying an unemployment benefit based on that highest quarter.

Therefore, seasonal workers’ unemployment benefits were based on a much higher income than they were actually making. For example, if a highway construction worker earned $30,000 in three months and was then unemployed the remaining nine months of the year, his unemployment benefits would reflect him making $120,000 a year.

“Under the new law, we will take a look at whatever money you’ve earned over a 12-month period and pay you an unemployment benefit based on that annualized number,” Hershman said. “For the vast majority of people who are in normal employment circumstances and are disrupted, it will have no impact on their benefits at all.”

The law would also place a cap on unemployment benefits so no more than 47 percent of an individual’s average earnings prior to layoff could be earned through unemployment benefits. Hershman said that number is the national average of the other 49 unemployment systems throughout the country.

Opponents of the law argue that it will instigate the unemployment problem by putting a monetary burden on businesses, which may thus be less willing to hire new employees or keep existing ones.

“When you take money out of somebody’s pocket, they are not able to invest it in their own business, and consequently they would not continue to employ certain people,” said Sen. Phil Boots, R-Crawfordsville, another Senate co-sponsor of the bill. “It’s not the best thing in the world ... if we don’t address the issue at the state level, the federal government will come in and address the issue and we don’t want to go there.”

Boots said if Indiana does not collect more money than is spent, the federal government will start reducing the state’s credit and will take over Indiana’s unemployment system. If the federal government were to impose its system, there would be a 6.2 percent premium on every employer for the first $7,000 each of their employees earns in wages in a year, he said.

The new Indiana law taxes employers half a percent for the first $9,500 each of their employees earns in wages in a year, Boots said. Despite the amounting debt legislators were trying to overcome, the new law lowers the premium from what it was before. However, a 13 percent surcharge was added on the premium.

The premium will go toward structurally balancing Indiana’s unemployment trust fund while the surcharge will go toward paying off the debt.

“If the unions want to express their concern on behalf of workers, I think they ought to be spending their time lobbying the federal government,” Hershman said. “The $2 billion we owe the federal government, they (the federal government) are trying to charge us a 4 percent interest rate — $70 million a year that has to come out of the Hoosier budget.”

Daniels signs bill stabilizing unemployment funds

Get stories like this in your inbox

Subscribe