This grant originated from a multimillion, multistate settlement from Chase Bank for recent illegal debt collection, which affected around 528,000 Americans and 7,000 Hoosiers.

Indiana was one of 47 states to receive money through the settlement.

“Let’s call it justice being served,” Zoeller said. “We’re putting the money back to protect the very consumers that we all hope to serve.”

In 2015, almost 8,000 Hoosier homeowners were in filing to lose their homes. Hundreds have sat in Indiana Legal Services attorney David Pesel’s office, seeking legal aid in fighting foreclosure.

Indiana was only one of five states to re-allocate the money toward foreclosure prevention agencies, Indiana Legal Services Managing Attorney Jamie Andree said Thursday.

“You were under no obligation to give any of that money to anyone,” Indiana Legal Services Executive Director Jon Laramore said to Zoeller. “We’re very appreciative.”

Pesel, who is the head foreclosure prevention attorney at Indiana Legal Services, said he sees one to two new clients each day, and there are some clients whom he has worked with for more than two years. His clients come from all over the state, but he is very active in Monroe County.

Lenders have been known to purposely over-assess the value of homes, Pesel said. When that happens, homeowners are forced to take out a loan that is way too big.

If and when a homeowner loses their job, Pesel said, suddenly the homeowner is “locked into” paying off a loan with interest rates far beyond where they should be.

This is just one example of how some “normal, hard-working Americans” end up in his office, Pesel said.

“New homeowners are usually very excited during this process,” Pesel said. “Sometimes we feel like there might have been a player in the closing process who pushed this through when they shouldn’t have.”

Zoeller recently oversaw two changes in Indiana statute regulating housing loans, and now lenders must be officially “bonded” to the state to legally lend money and are no longer allowed to accept money up front.

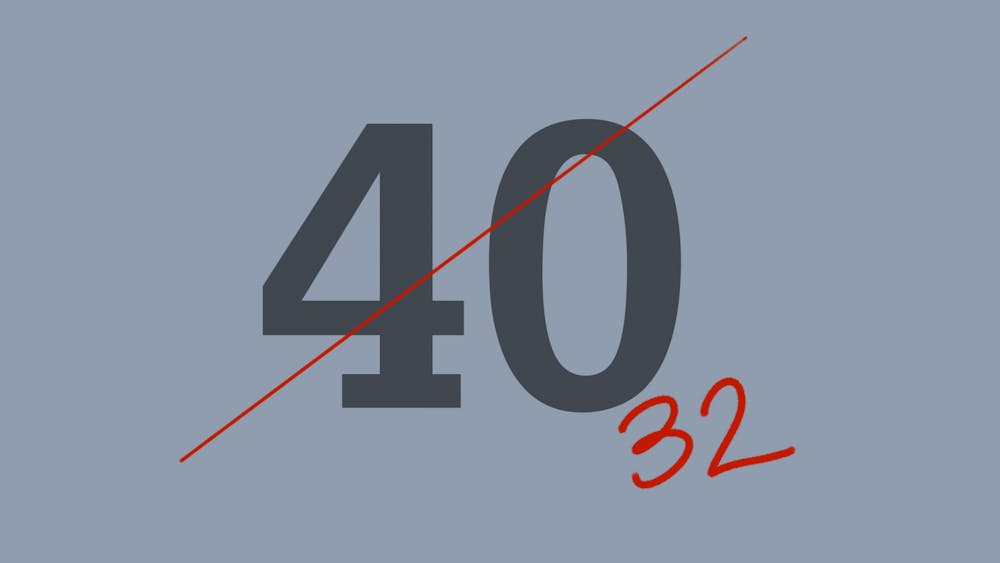

At one point in the early 2000s, Indiana led the country in foreclosures, Andree said. But in October of last year, Indiana fell to 10th on that list, with 7,940 homes filing for foreclosure and a foreclosure rate of one out of every 353 homes, according to RealtyTrac’s annual report.

Because the economy is improving, everyone feels a sense of relief after suffering through the 2008 recession, Zoeller said. But that sense of overall improvement is not felt by everyone around the state.

“If you talk to the lawyers here or the lawyers in my office, you’ll hear stories that it’s still a struggle for a lot of people who are under the gun,” Zoeller said.

“And when your mortgage is being foreclosed, you’ve probably got three or four other debt problems that you don’t know which one to pay, and you don’t know where to go for help.”

When Chase Bank can successfully con 528,000 people into paying off debt that doesn’t exist, the shadiest of lenders can con consumers with bad home loans, Pesel said. And foreclosure can happen to anyone, low-income or not, he added.

“People think that foreclosure victims are somehow not good citizens or bad money managers, and the fact is, they’re regular hardworking people,” he said.

“A typical foreclosure is a very normal, hardworking American citizen who has a bit of bad luck.”