An unemployment benefit program that has aided more than 600,000 Hoosiers since it began is planned to expire by the end of December.

The benefit program was signed in 2008 to provide emergency federal benefits during the recession.

According to the Indiana Department of Workforce Development, around 18,800 Hoosiers are currently receiving the extended benefits.

Joe Frank, a spokesman for The Indiana Department of Workforce Development, said Hoosiers initial claims for unemployment benefits are the lowest they’ve been since the program started.

“We’re just not seeing the claims traffic like we’ve seen since before the recession,” Frank said.

Frank said the decline in claims is a result of fewer unemployed Hoosiers and more people going back to work.

“From what we’re seeing is, there’s just more jobs,” Frank said. “Businesses are creating more jobs, more jobs are available, and people are just going back to work. The raw numbers show that people are going back to work.”

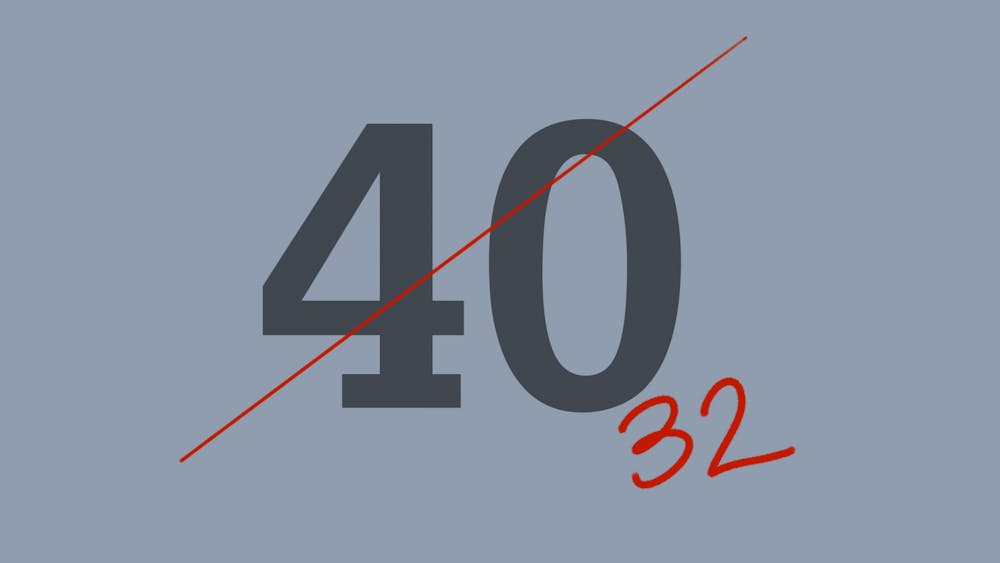

Indiana’s unemployment rate is 7.5 percent, compared to the 7.3 percent national rate. Indiana’s unemployment rate level will qualify Hoosiers to receive 37 weeks of extra benefits through the federal unemployment extension after the 26 weeks expire.

“Our unemployment rate over the past three plus months has gone down by nearly 1 percentage point,” Frank said. “The unemployment rate for Indiana for October was down to 7.5 percent and back in July it was at 8.4 percent and statistically that’s a large decline.”

Frank said Hoosiers would still be entitled to all the services that WorkOne offers to anybody that is a job seeker if the benefits expire.

“They can certainly come into WorkOne if they haven’t already, and we sure hope they have already, to try to see what different education and training services we offer through WorkOne so we can get them back to work as soon as possible,” Frank said.

However, Derek Thomas, senior policy analyst for the Indiana Institute for Working Families, said his concern with cutting the extended relief is that it will drive more people to give up looking for work altogether and drop out of the labor force.

“Hoosiers have seen stagnating wages, and one-third of our state is below levels of economic self sufficiency, which means they can’t afford the most basic needs of a family and now is not the time to be cutting more benefits for Hoosier families,” Thomas said.

In the fourth quarter of 2012, 67 percent of Indiana’s unemployed were not receiving unemployment insurance benefits, the 42nd least generous in the U.S, Thomas said. Thomas said Indiana has some of the lowest average weekly unemployment benefits and also have more poverty-waged jobs than all of its neighboring states.

“Cutting unemployment benefits is not going to magically encourage folks to just start going out and looking for work when the pay is still below the poverty guidelines, when many of these jobs being created are poverty-waged jobs,” Thomas said.

Thomas said they have been proposing a policy called Work Sharing, a bill that would help to reduce the costs of the state’s long term unemployment to tax payers through benefits and also to the workers.

“While we support the extension of long term benefits in the short run, we’d also like lawmakers to start thinking about how we can better design our unemployment benefit system,” Thomas said.

Thomas said people need to start raising the minimum wage and making some changes to the unemployment system, i.e. Work Share.

“As long as we keep taking money out of the hands of families, whether it be unemployment benefits, SNAP benefits, the more this is going to affect our overall economy because families don’t have enough of the money to spend within their communities,” Thomas said. “These policies are not just there to provide some integrity and relief to families, but they are also economic development policies.”

Follow reporter Alli Friedman on Twitter @allifrie.

Benefits for jobless expected to expire

Get stories like this in your inbox

Subscribe